Welcome to the world of online transactions, where the convenience of PayPal has undoubtedly become a household name. But as you’re probably aware, the magic of PayPal’s “Goods and Services” feature does come with a cost, and that’s where the PayPal Goods and Services fee steps into the limelight.

- Key Takeaways

- Understanding PayPal Goods And Services

- How PayPal Goods And Services Fee Work?

- Why Does PayPal Charge A Fee?

- PayPal Goods And Services Fee

- PayPal Fees For Sending Money

- PayPal Fees For Receiving Money International

- Does PayPal Charge A Monthly Fee?

- How Can You Avoid PayPal Fees When Receiving Money?

- PayPal Alternatives

- Is PayPal A Great Deal?

- Real-Life Examples On PayPal

- FAQs (Frequently Asked Questions) On PayPal Goods And Services Fee

- Final Thoughts On PayPal Goods And Services Fee

We’ll unravel the mysteries of this fee, demystify its workings, and help you understand how it impacts your online shopping and selling adventures.

So, let’s dive into the fascinating realm of PayPal Goods and Services fees and discover how they play a crucial role in the online financial landscape.

PayPal Goods and Services fee – that’s the phrase we’ll be echoing a few times, so you’re prepared for whatever comes your way!

Key Takeaways

- Selecting the Goods and Services option allows you to make payments from free PayPal purchase protection.

- If you send funds from a personal account, you won’t incur any charges when using this money transfer method.

- PayPal Goods and Services facilitates the transfer of funds from your account to the merchant’s account when you purchase goods or services online.

- If you run a registered business and anticipate receiving payments regularly, it’s advisable to establish a business account.

- If you’re a buyer, you won’t need to be overly concerned about service fees. However, sellers are subject to fees, the exact amount of which varies based on the specific types of transactions they engage in.

- As a consumer, you won’t be responsible for covering PayPal fees when you make purchases or send money to friends and family.

- The typical PayPal fees for receiving funds are 2.9% plus $0.30 when both accounts are within the United States. If the client’s account is based in another country, then it charges 4.4% plus $0.30.

- Creating your account and obtaining a card comes at no cost, and PayPal does not impose a monthly fee or demand a minimum balance.

Understanding PayPal Goods And Services

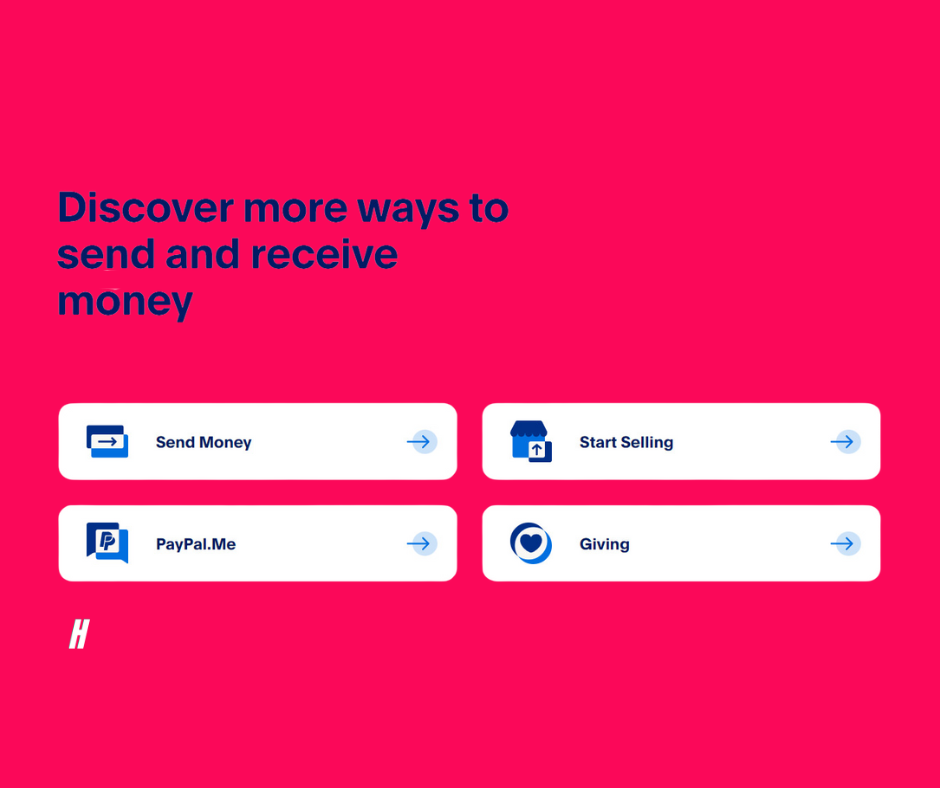

PayPal Goods and Services represents one of the two methods for sending or receiving money through PayPal, with the alternative being Friends and Family payments.

The Goods and Services feature distinguishes itself for two key reasons:

Choosing the Goods and Services option to make payments allows you to benefit from free PayPal purchase protection.

This ensures that when you use this choice, you’re safeguarded against fraudulent activities, and you can contest transactions in cases where you do not receive the expected goods or if the items received do not match the description upon which your purchase was based.

You won’t incur any charges when using this money transfer method, provided you’re sending funds from a personal account.

The recipient, typically the merchant, will be responsible for covering the processing fee.

Now, let us see how PayPal Goods and Services fees work in the next section.

How PayPal Goods And Services Fee Work?

PayPal Goods and Services caters to two distinct categories of users: consumers who make purchases and merchants who conduct sales.

Consequently, the functionality of the platform varies depending on whether you’re a buyer or a seller. The reassuring aspect is that the service is designed to be user-friendly regardless of your role in the transaction.

In The Case, You’re A Consumer

From the buyer’s perspective, PayPal Goods and Services facilitates the transfer of funds from your account to the merchant’s account when you purchase goods or services online. You can do this by following the process:

- Log in to your PayPal account or via the mobile app.

- Navigate to the “Send and Request” section and select the “Send” option.

- Enter the seller’s details, which can include their name, email address, PayPal username, or mobile phone number.

- Specify the amount of money you wish to pay.

- Choose the currency in which you’d like to make the payment.

- You can also include a note if needed.

- Decide how you’d like to make the payment, using your PayPal balance or one of the saved payment methods in your account.

- Finally, click or tap “Send payment now” to complete the transaction.

In The Case, You’re A Merchant

From the perspective of the seller, who receives payments via PayPal, requesting money from your customers is a simple process. Here’s a simple guide on how to do it:

- Sign in to your PayPal account either online or through the mobile app.

- Navigate to the “Send and Request” section and select the “Request” option.

- Enter the customer’s information, which usually consists of their PayPal username, email, or phone number.

- Specify the amount of money you want to request from your customer.

- You can also include a note if needed.

- Click the “Send” button to start the request.

The purchaser will receive an email notification informing of your money request, and they can proceed to make payment using their PayPal account.

If you run a registered business and anticipate receiving payments on a regular basis, it’s advisable to establish a business account.

A Business account will enable you to handle payments both in-person and online, as well as generate invoices and set up subscription services through PayPal.

Why Does PayPal Charge A Fee?

PayPal operates as a publicly-traded and profit-driven company that primarily derives its revenue from fees. There are many reasons why PayPal charges a fee:

- PayPal provides a secure platform for online transactions, which requires ongoing maintenance and security enhancements. The fee collection helps cover these operational costs.

- Processing payments and money transfers involve costs such as payment processing fees and currency conversion fees. PayPal charges fees to offset these expenses.

- PayPal continually develops and introduces new payment solutions and technologies. The revenue from fees supports research and development efforts.

- PayPal offers responsive customer support and requires resources & personnel. Part of the fees ensures that users receive timely assistance.

- PayPal invests in strong fraud prevention & detection systems to safeguard users’ financial information. The fees contribute to maintaining these security measures.

- PayPal is a for-profit company, and charging fees is a primary means of generating revenue and profits for its shareholders.

Now, let us know about the PayPal Goods & Services fee in the next section.

PayPal Goods And Services Fee

PayPal Goods and Services Fee is often referred to as the PayPal fee. It is a charge imposed by PayPal for processing payments when you use their platform for commercial transactions.

When you receive payments for goods or services through PayPal, the sender may have the option to choose between sending money as “Friends and Family” or for “Goods and Services.”

If the sender selects “Goods and Services,” a fee is applied to the transaction. This fee is typically a percentage of the total transaction amount plus a fixed fee. The exact fee structure can vary depending on your location and the currency used for the transaction.

PayPal charges this fee to cover the cost of providing payment processing services, buyer and seller protection, and other features that are beneficial for commercial transactions.

If you’re a buyer, you won’t need to be overly concerned about service fees. However, sellers are subject to fees, the exact amount of which varies based on the specific types of transactions they engage in.

PayPal’s fees for merchants involved in commercial transactions can vary depending on the payment method, which PayPal refers to as the Alternative Payment Method (APM).

These commercial transactions include the sale of goods and services, and they may also include various other types of commercial exchanges.

To provide you with a clear understanding of PayPal’s fee structure, here’s a chart:

| PAYMENT TYPE | MERCHANT FEE |

| PayPal checkout | $3.49 plus a fixed fee |

| Sending & receiving money for goods or services | 2.99% |

| QR transactions | $1.90 to $2.40 plus a fixed fee |

| Credit and debit card payments | 2.99% plus a fixed fee |

| Alternative payment methods | Various rates depending on the type of payment method |

It’s important to note that all international transactions carry an additional fee. Furthermore, the fixed fee added to the base rates outlined in the chart is influenced by the currency you’re using and the total transaction amount.

Now, let us look at the PayPal fees for sending money in the next section.

PayPal Fees For Sending Money

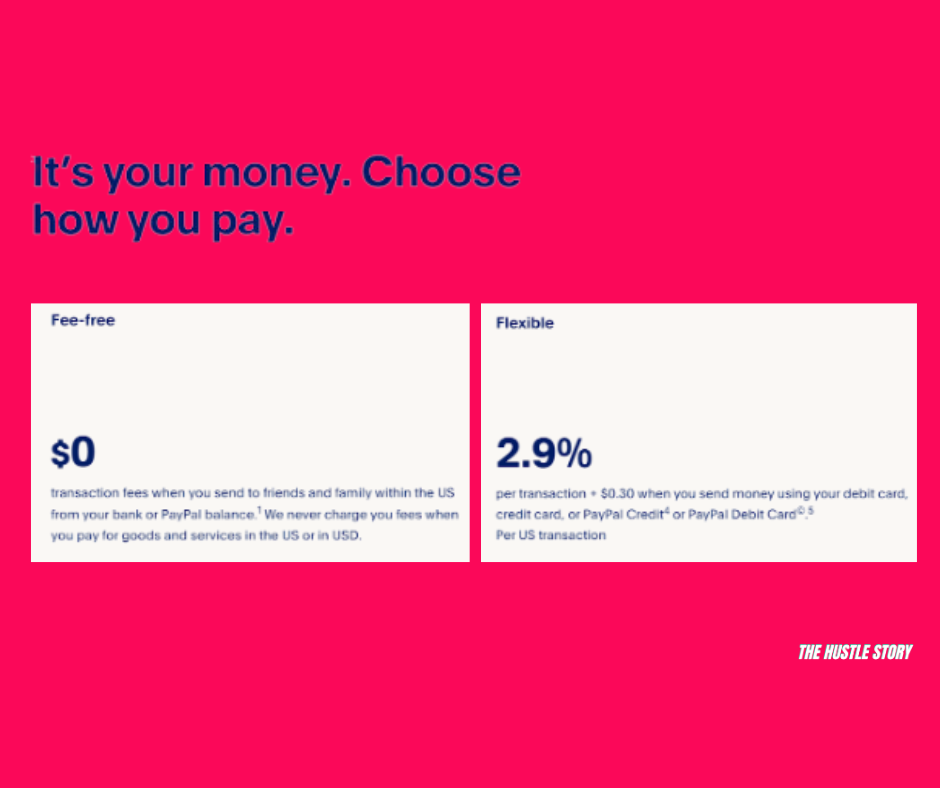

As a consumer, you won’t be responsible for covering PayPal fees when you make purchases or send money to friends and family. These fees are typically borne by either the seller or the recipient of the payment, depending on the nature of the transaction.

If you prefer to use a credit card in lieu of a linked bank account or debit card for money transfers, you’ll incur a charge of 2.9% plus 30¢.

There is an extra 5% fee for international transactions, with a minimum fee of 99¢ per transaction and a maximum fee of $4.99 per transaction.

PayPal Fees For Receiving Money International

The typical PayPal fees for receiving funds are 2.9% plus $0.30 when both accounts are within the United States. If the client’s account is based in another country, then it charges 4.4% plus $0.30.

In both cases, the customer is exempt from paying any fees, even if their account is from a different country.

However, when you send money to friends and family using your PayPal account, you may incur a small fee.

Does PayPal Charge A Monthly Fee?

Creating your account and obtaining a card comes at no cost, and PayPal does not impose a monthly fee or demand a minimum balance.

Furthermore, they do not levy charges for inactivity or infrequent card usage. However, a fee of up to $3.95 may be applicable when you load cash into your PayPal balance at participating stores.

Now, let us know how to avoid PayPal fees on receiving payments in the next section.

How Can You Avoid PayPal Fees When Receiving Money?

Some strategies can reduce expenses. Here are they:

- You need to reduce the frequency of customer payments. PayPal applies both a per-transaction fee and a percentage fee. When you reduce the number of transactions, it will result in fewer per-transaction fees.

- You can accept cash, checks, & ACH transfers as they are more cost-effective choices.

- Investigate the possibility of deducting fees as a business expense. According to IRS Publication 535, expenses that are related to accepting credit cards might be eligible for deduction.

PayPal Alternatives

There are several alternatives to PayPal for online payments and money transfers. Here are some of the popular ones:

Stripe

Stripe is a widely used payment gateway that allows businesses to accept online payments. It’s known for its developer-friendly tools and customizable options.

Square

Square offers a range of payment processing solutions, including in-person and online payments. They provide a variety of hardware and software options for businesses.

Authorize.Net

Authorize.Net is a payment gateway that’s been around for a long time. It’s known for its reliability and ease of integration with various e-commerce platforms.

Payoneer

Payoneer is known for its cross-border payment solutions. It’s often used by freelancers and businesses that work with clients globally.

Braintree

Braintree, a subsidiary of PayPal, is another payment processing option. It’s popular for its flexibility and support for mobile payments.

Adyen

Adyen is a global payment company that offers a comprehensive payment platform for online, mobile, and in-store payments.

Shopify Payments

If you run an ecommerce store on Shopify, you can use their built-in payment processing system called Shopify Payments, which is easy to set up.

Amazon Pay

Amazon Pay allows customers to use the payment methods already associated with their Amazon accounts to make online payments.

Skrill

Skrill is a digital wallet that allows you to send and receive money online. It’s a popular choice for international money transfers.

Venmo

Owned by PayPal, Venmo is a popular mobile payment app that allows you to send and receive money from friends and family.

Now, let us know in the next section whether PayPal is a great deal.

Is PayPal A Great Deal?

PayPal offers businesses and customers a user-friendly experience that makes it an attractive option for many businesses.

While you may incur slightly higher per-transaction fees with PayPal, the convenience of collecting payments from your customers could outweigh the additional cost.

PayPal stands out for its easy website integration and seamless payment processes. It’s crucial to consider these factors when evaluating whether PayPal is the right choice for your business.

Real-Life Examples On PayPal

Here are the real-life examples on PayPal:

A Reddit user considers PayPal great for online payments, not regular bills. He uses them as a buffer between my bank accounts and online merchants.

Another Reddit user has been using PayPal for the past 10+ years, and he never faced a single issue.

FAQs (Frequently Asked Questions) On PayPal Goods And Services Fee

1. How do I avoid PayPal goods and services fees?

You can avoid PayPal goods and services fees in the following ways:

- Establish a Business Account

- Choose the “Friend or Family” payment option

- Explore fee reduction options

- Consider deducting PayPal fees from your tax returns

- Explore alternatives to PayPal.

2. Who pays the PayPal goods and services fee?

PayPal uses PayPal Purchase Protection to cover eligible payments for goods and services. When you opt for this payment method, the seller incurs a nominal fee to receive your funds.

Final Thoughts On PayPal Goods And Services Fee

When it comes to PayPal’s Goods and Services fee, it’s essential to understand its impact on your transactions, especially if you’re using PayPal for business or online selling.

PayPal Goods and Services enables the movement of money from your account to the seller’s account when you engage in online transactions to buy products or services.

While PayPal’s Goods and Services fee is a consideration, it’s one of the costs associated with running an online business or conducting transactions securely online.

If you’re concerned about the fees, consider offering alternative payment methods to your customers. Some may prefer using platforms like Venmo, Cash App, or even traditional bank transfers, which might have lower or no fees.

Remember that understanding the fee structure, exploring alternatives, and factoring it into your pricing strategy can help you make informed decisions & manage finances effectively.

I hope this article on PayPal goods and services fees sounds helpful!

![21 Worst Shark Tank Failures And Why They Failed? [2024] 16 Shark Tank Failures](https://thehustlestory.com/wp-content/uploads/2021/11/Shark-Tank-Fails-Blog-Banner-2.jpg)