Have you ever imagined being your boss, setting your hours, and making money while you sleep? Well, the rental property business might just be your ticket to this dream.

The rental property business has proven to be a stable and profitable venture for many entrepreneurs over time. It’s a thriving industry that offers promising returns and financial stability if done right.

Starting a rental property business can be a fantastic way to generate a steady income, increase your wealth, and secure your financial future.

Now, we know what you’re thinking: all this sounds great, but where do I start? How do I navigate through the complexities of the real estate market, legalities, financing, and more?

Don’t worry; we’ve got you covered.

In this comprehensive guide on how to start a rental property business, we’ll walk you through each step of starting your own rental property business — from understanding the real estate market and determining your niche to choosing the perfect location, securing finances, dealing with legalities, setting up operations, managing properties, and even growing your business.

Are you ready? Let’s dive in!

Understanding the Real Estate Market

Now that you’ve decided to dive into the rental property business, the first step is understanding the real estate market you are entering.

This means knowing the current trends, demands, and opportunities.

Why is that, you ask?

Market research plays a crucial role in the rental property business. It’s not just about knowing what properties are up for sale; it’s about understanding the dynamics of the market,

It keeps you competitive by staying on top of market trends and changes. It reduces risk by providing insights into property values, rental rates, and occupancy levels. Plus, it aids in setting profitable yet attractive rental rates.

Tips for Staying Updated with Real Estate Trends

Staying updated with real estate trends is a must if you want to learn how to start a rental property business.

Here are some tips:

1. Become a News Junkie

First things first, make news your best friend. Subscribe to real estate newsletters, follow real estate blogs, and tune into property podcasts.

Websites like Realtor.com, Zillow, and Trulia are your go-to sources for the latest industry news. Remember, knowledge is power!

2. Leverage Social Media

Did you know social media can be a goldmine for real estate trends?

Platforms like LinkedIn, X, and Instagram are teeming with industry experts sharing insights and predictions. So, why not follow a few and join the conversation?

3. Attend Real Estate Events

Ever thought about attending real estate seminars, webinars, or networking events? These are fantastic platforms to learn from industry leaders and meet like-minded individuals. You never know – the next big trend might just be a conversation away!

4. Join Online Forums

Online forums like Reddit and Quora can be treasure troves of information. You’ll find real people sharing real experiences and insights – a priceless resource when it comes to understanding trends on the ground.

5. Engage with Local Communities

Last but not least, don’t forget your local community. Engage with local real estate agents, property managers, and even fellow investors. They’re likely to have their fingers on the pulse of local trends.

How to Identify Profitable Markets?

In rental property businesses, identifying profitable markets is a bit like discovering gold, especially if you’re learning how to start a rental property business. It’s a process that requires keen insight, careful analysis, and a dash of intuition.

But how do you uncover these hidden gems? Let’s break it down.

Understanding Market Dynamics

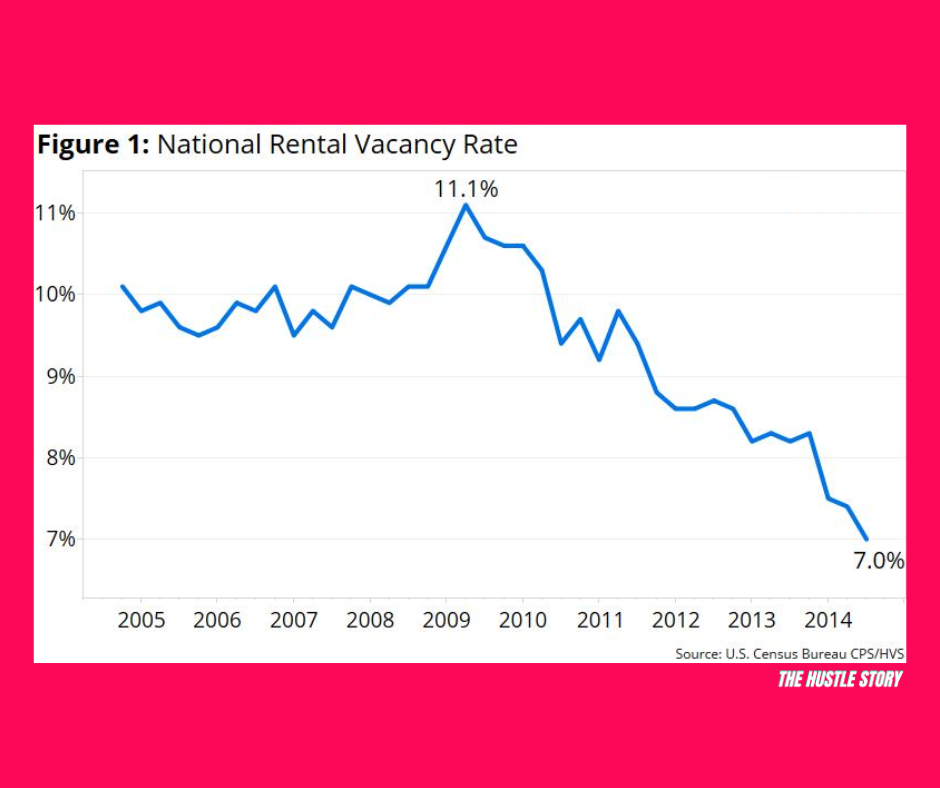

Begin by understanding the basic supply and demand dynamics of the rental market. High demand coupled with low supply often indicates a profitable market.

Here’s how to gauge them:

- Demand: Look at factors such as population growth, employment rates, and local amenities. Are people moving to the area for job opportunities? Are there schools, hospitals, shopping centers, or recreational facilities nearby that may attract renters?

- Supply: Consider the current availability of rental properties in the area. If there’s a shortage of rentals but a high demand, it could signal a potentially profitable market.

Conducting a Rental Market Analysis (RMA)

A rental market analysis is your compass in the journey of identifying profitable markets and learning how to start a rental property business. This involves researching comparable rental properties in your preferred area.

Here’s how to go about it:

- Identify Comparable Properties: Find properties similar to the one you’re considering in terms of size, location, amenities, and age.

- Analyze Rental Rates: Determine the average rental rate for these comparable properties. This will give you an idea of what you might expect to charge tenants.

- Evaluate Amenities: Look at the amenities offered by these properties. Are they providing free parking, laundry facilities, or gym access? Your property’s amenities can significantly affect the rental price and attract potential tenants.

Looking at Occupancy Levels

High occupancy levels can suggest a profitable market. If most properties are rented out most of the time, it’s a good sign that demand is high.

But how do you find this information?

- Online Research: Websites like Zillow, Trulia, and Rentometer provide data on rental occupancy rates in various areas.

- Local Real Estate Agents: Local agents usually have a pulse on the market and can provide insights into occupancy levels.

Considering Property Values

Analyzing property values is another crucial step in identifying profitable markets. Here’s what to keep in mind:

- Historical Trends: Look at property value trends over the past few years. Have they been increasing? Properties in areas where values are rising could be good investments.

- Future Growth: Research any future developments planned in the area that could increase property values, such as new businesses, infrastructural improvements, or urban regeneration projects.

Analyzing Local Economy

The local economy can significantly impact rental demand and profitability. Consider factors like:

- Job Market: A robust job market can attract people needing rental accommodation.

- Income Levels: High local income levels can allow for higher rental rates.

- Economic Stability: Stable economies tend to be safer bets for property investment.

Identifying profitable markets is both an art and a science. It involves careful analysis, a deep understanding of the real estate landscape, and, sometimes, trusting your gut.

Every profitable journey in the rental property business starts with finding the right market.

And now you’re equipped with the knowledge on how to start a rental property business and do just that.

How To Start A Rental Property Business?

So, how to start a rental property business?

The rental property management business is a lucrative venture that can be started with the right knowledge and strategies. Here’s an overview of how to get started.

Determining Your Niche: Different Types of Rental Properties

Starting a rental property business is an exciting venture. But before you dive in, it’s essential to determine your niche in order to know how to start a rental property business.

Understanding the different types of rental properties available and deciding which type is right for you can pave the way for your success in this industry.

Types of Rental Properties

There’s a diverse range of rental properties that you can consider investing in. These include:

- Single-family homes: These are standalone residences that offer privacy and space. They’re popular among families and long-term renters.

- Multi-family homes: These are buildings with multiple separate housing units, such as duplexes and apartment complexes. They can provide a steady income stream as you’ll have multiple tenants.

- Commercial properties: These are properties rented out to businesses. They often come with long-term leases, providing a stable income.

- Vacation rentals: These are properties in tourist locations, rented out short-term to vacationers. These can yield high returns during peak seasons.

Choosing the right type of rental property depends on various factors, including your budget, risk tolerance, and management preferences.

How To Decide Which Type Of Rental Property Is Right For You?

As you ponder on how to start a rental property management business, consider the following points to help you decide which type of rental property is right for you:

1. Consider Your Budget

First off, take a good look at your budget. What can you realistically afford?

Single-family homes often require a lower initial investment compared to multi-family or commercial properties.

If you’re just starting, it might make sense to start small and gradually scale up as your profits grow.

Read: How To Start A Business With No Money In 10 Steps

2. Assess Your Risk Tolerance

Next, think about your risk tolerance. Every type of property comes with its own set of risks and rewards.

Commercial properties, for instance, often come with long-term leases that can provide a stable income. However, they can also be more vulnerable to economic downturns.

Are you comfortable with this level of risk, or would you prefer the relative stability of residential rentals?

3. Understand Your Management Preferences

Now, let’s talk about management. Do you enjoy being hands-on, or would you rather delegate to others?

Managing a single-family home can be simpler than looking after an apartment complex or a string of vacation rentals.

But if you’re keen on hiring a property manager, then the type of property might not matter as much.

4. Conduct Market Research

Finally, never underestimate the power of market research when considering how to start a rental property business.

What works well in one area might not be the same in another. Is there a high demand for vacation rentals in your locale, or are commercial properties more popular?

Understanding these trends can help guide your decision.

There’s no ‘one-size-fits-all’ answer here. The best type of rental property for you depends on your circumstances, goals, and comfort levels.

It’s like finding the right pair of shoes – it needs to be a perfect fit!

Factors to Consider When Choosing a Location for Your Rental Property

As you navigate how to start a rental property business, one factor stands out above the rest: location.

The location of your rental property can significantly impact its profitability and long-term success.

What makes a location ideal?

Here, we delve into the key factors to consider when choosing a location for your rental property.

1. Demand and Supply

First and foremost, assess the demand and supply dynamics in the area. An ideal location is one with high demand for rental properties, but the supply is limited.

This scenario ensures a steady stream of potential tenants, and you can command competitive rental rates.

2. Proximity to Amenities

Tenants, whether families, individuals, or businesses, value convenience.

Properties close to amenities such as schools, public transportation, shops, parks, and healthcare facilities are often more attractive to renters.

If you’re considering investing in vacation rentals, proximity to tourist attractions is a vital factor.

3. Safety

Safety is a significant concern for most renters. The perceived safety of a neighborhood can significantly affect rental demand.

Therefore, it’s essential to check local crime statistics and speak with residents and local law enforcement about safety concerns before investing in a property.

4. Employment Opportunities

Areas with robust job markets tend to have higher rental demand.

If a location has growing industries attracting workers from other areas, it’s likely to be a good market for rental properties.

5. Future Developments

Keep an eye on upcoming infrastructure or commercial developments in the area.

New schools, hospitals, shopping centers, or transport links can boost the desirability of a location and push up property values.

Check with local city planning departments to understand future development plans.

6. Property Taxes

Property taxes can eat into your profits, so it’s important to consider them when choosing a location.

Higher property taxes aren’t always a bad thing if the area is attractive to renters, but it’s important to ensure the numbers add up.

7. Natural Disaster Risk

Some locations are more prone to natural disasters than others. Understand the risks associated with an area, such as floods, earthquakes, or hurricanes, and factor in the cost of appropriate insurance.

8. Local Rental Regulations

Some cities have stringent regulations for landlords and rental properties. Understanding these laws can help you avoid potential legal issues and fines.

Choosing the right location for your rental property is a multi-faceted decision that requires thorough research and careful consideration.

It’s not just about the property but also the wider community and market conditions.

How To Start A Small Rental Business: The Legal Essentials

Starting a rental property business can be an exciting and rewarding venture. But before you dive in, it’s essential to understand the legal requirements involved.

Let’s break down those steps one by one!

Step One: Choose Your Business Structure

When setting up your rental property business, one of the first steps is to register your business. This typically involves filing documents such as articles of incorporation or organization with the Secretary of State‘s office.

Let’s take a moment to consider one of the most critical decisions you’ll make – choosing your business structure. Don’t worry; we’re here to walk you through the process.

1. Sole Proprietorship

Let’s start with the simplest form: a sole proprietorship.

In a sole proprietorship, you are the business. There’s no separation between you and your company. Sounds liberating, right?

But hold on—there’s a flip side. With no separation between you and your business, you’re personally responsible for all the business’s debts and liabilities.

If something goes wrong (and in business, things can sometimes go awry), your assets could be at risk. It’s like walking a tightrope without a safety net.

So, while a sole proprietorship might be simple to set up, it’s not always the safest choice.

2. Partnership

Next up, we have partnerships. Fancy sharing the responsibilities, costs, and, yes, the profits too? A partnership might be the way to go.

But remember, as with any relationship, communication is key. You’ll want clear agreements about who is responsible for what, how decisions will be made, and how profits will be divided.

The downside? Like a sole proprietorship, partners have unlimited personal liability for the business’s debts. It’s like being in a three-legged race – if your partner stumbles, you’re going down too.

3. Corporation

Now, let’s talk about corporations. If you’re thinking big and planning to invite investors on board, a corporation could be your best bet.

Corporations are separate legal entities from their owners, providing the most personal liability protection.

But with great power comes great responsibility, right?

Corporations are subject to more regulations and have higher administrative costs. Plus, there’s the potential for double taxation – once on the corporate income and again on dividends paid to shareholders.

4. Limited Liability Company (LLC)

Finally, we come to the Limited Liability Company, or LL, as it’s commonly known. Think of it as the Goldilocks choice – not too big, not too small, but just right for many rental property owners.

An LLC combines the liability protection of a corporation with the tax benefits and simplicity of a sole proprietorship or partnership.

While setting up an LLC is more complex than a sole proprietorship or partnership, it provides a safety net of limited personal liability. And who wouldn’t want that peace of mind?

Choosing your business structure isn’t a decision to be taken lightly. It can significantly impact your liability, taxes, paperwork, and ability to raise money.

So, take some time, do your research, and perhaps consult with a business advisor or attorney.

Step Two: Pick Your Business Name

Are you ready for a fun and creative part of learning how to start a rental property business? It’s time to choose the name for your rental property business!

Now, this isn’t just about picking something that sounds cool. No, it’s much more than that. Your business name is like a handshake, introducing your brand to potential clients.

Think of it as painting a picture. What do you want people to feel when they hear your name? Trustworthiness? Innovation? Comfort?

Jot down words that resonate with your vision. But remember, it’s not just about you; it’s about your audience too. Will they get it?

ChatGPT is a great tool to help you brainstorm some ideas.

Once you have a few names in mind, do some detective work. Is the name available? Is it legally compliant?

And most importantly, does it pass the ‘say-it-out-loud’ test? If it checks all these boxes, congratulations! You’ve just taken another step closer to launching your rental property business.

Step Three: Register Your Business Name

After you’ve chosen the perfect name for your business in step two, the next crucial step is to register it.

This step might seem simple, but it’s of utmost importance as it legally secures your unique business name and ensures that no other entity can use it.

How to Register Your Business Name?

Registering a business name varies depending on your state and business structure. Here’s a general guide to help you understand the process:

1. Check Business Name Availability

Before registering your business name, you’ll need to make sure it’s available. This involves checking with your state’s business registry to ensure no other business is already using your chosen name. Many states offer an online database that allows you to search for existing business names.

2. Register with State Agencies

Once you’ve confirmed your business name is available, the next step is to register it with the appropriate state agency.

In most cases, this will be your state’s Secretary of State’s office. The process usually involves filling out a form with information about your business and paying a filing fee.

If you’re operating as a sole proprietorship or partnership, you may need to file a Doing Business As (DBA) registration if your business name is different from your name.

3. Consider Trademark Protection

If your business will operate nationally or internationally, you might consider registering your business name as a trademark with the U.S. Patent and Trademark Office. This will provide additional protection and prevent other businesses from using your name nationwide.

Each state has its own set of rules and regulations, so be sure to check them before you proceed.

Step Four: File the Necessary Paperwork

Alright, folks! We’re making progress on how to start a rental property business. Now, let’s tackle the necessary paperwork. This might sound intimidating, but don’t worry! We’ve got you covered.

If you’ve decided to form an LLC (Limited Liability Company), this step is all about your articles of organization. Think of these like your business’s birth certificate. They set up the legal foundation for your company.

“But what are these articles of organization?” I hear you ask.

Well, they are documents you file with your state’s business filing office. These essential papers outline key details about your business. They include things like:

- Your business name (that catchy one you just registered).

- The purpose of your business (in our case, a rental property business).

- Your business address.

- The name and address of your registered agent (the person or company that will receive legal documents on behalf of your LLC).

- The management structure of your LLC (whether members or managers manage it)

Each state has its specific requirements for what to include in the articles of organization, so you’ll need to check with your local regulations.

Filing these documents officially makes your business a recognized entity in the eyes of the law. It’s a big step, but you’re equipped! Just take it one piece at a time, and before you know it, you’ll be the proud owner of a legally registered rental property business.

Step Five: Get an Employer Identification Number (EIN)

Before starting your rental property business, you’ll need to obtain an Employer Identification Number (EIN). This unique number is assigned by the Internal Revenue Service (IRS) and is used for tax purposes.

Think of EIN as getting your business its very own Social Security Number. That’s essentially what an Employer Identification Number (EIN) is.

“Why do I need an EIN?” you might ask. Great question! An EIN is necessary for many reasons:

- It allows the IRS to identify your business for tax purposes.

- If you plan on hiring employees, you’ll need an EIN.

- Most banks require an EIN to open a business bank account.

- Some business licenses and permits require an EIN.

Getting an EIN is a relatively straightforward process. You can apply for one online through the IRS website. It’s free, and once you complete the application, you’ll receive your EIN immediately.

Now, we know this might feel like a lot of red tape, but remember, each step you take is bringing you closer to your dream of owning a rental property business

Step Six: Open a Business Bank Account and Get a Business Credit Card

To keep your personal and business finances separate (and make your accountant happy), you’ll want to open a dedicated business bank account and get a business credit card.

Here are a few reasons why keeping your business and personal finances separate is a good idea:

- Simplified bookkeeping: A dedicated business account makes it easier to track income and expenses and calculate taxes.

- Professionalism: Paying from a business account or card adds credibility to your rental property business.

- Limited liability protection: If your business is an LLC, separating personal and business finances is essential for maintaining liability protection.

- Building credit history: A business credit card can help your business build its credit history.

So, how do you go about opening a business bank account? Here’s a quick rundown:

- Choose a bank: Look for banks that offer services tailored to small businesses. Compare fees, minimum balance requirements, and transaction limits before deciding.

- Gather necessary documentation: This typically includes your EIN, business formation documents, and business license.

- Open the account: Visit the bank in person or open an account online, if available.

Next, let’s talk about getting a business credit card. Much like a personal credit card, a business credit card allows you to borrow money for purchases.

The benefits? Besides building credit, many business credit cards offer rewards like cash back or travel points.

Opening a business bank account and securing a business credit card is a significant step towards legitimizing your business and setting yourself up for financial success.

Step 7: Obtain the Necessary Business Licenses and Permits

Now that you have your business structure set up and your finances in order, it’s time to make sure you have all the necessary licenses and permits to operate a rental property business legally.

The exact licenses and permits required will vary depending on your location, but here are a few common ones to consider:

- Business Operation License: This license allows you to operate your business in a particular city or county. The requirements vary, so check with your local government office.

- Building and Housing Permits: If you plan on making any changes to your rental properties (like renovations or additions), you’ll likely need a building permit.

- Landlord or Rental License: Some cities require landlords to obtain a license before renting out their properties.

- Health and Safety Permits: Depending on your location and the property type you’re renting out, you may need health and safety permits. These could include fire department permits, air and water pollution control permits, and sign permits.

- Zoning Permits: These permits ensure that your rental property is being used in a way that’s consistent with local zoning laws.

- Sales Tax License: If you are required to collect sales tax on the rent you charge, you may need a sales tax license or permit.

It’s essential to research and obtain all the necessary licenses and permits for your specific area. Failure to do so could result in fines, penalties, or even legal action against your business.

Tips for Success In Your Rental Property Business

You’ve taken all the necessary steps to set up your rental property business, and now it’s time to make it a success!

Here are some tips to help you along the way on how to start a rental property business:

1. Become a Member of a Property Investors Network

A Property Investors Network is like a goldmine of knowledge and connections. It’s a community where experienced investors and newcomers like yourself come together. Think of it as your very own support group, filled with people who understand the challenges and rewards that come with the rental property business.

Now, you might be wondering, “What can I gain from joining such a network?” Well, imagine having access to a wealth of insights from seasoned professionals.

They’ve been where you are now, and they’ve learned valuable lessons along the way. And the best part? They’re more than willing to share their experiences with you.

But it’s not just about learning. It’s also about forming connections – connections that could lead to partnerships, collaborations, or even mentorships. Remember, in business, who you know often matters just as much as what you know.

2. Specialize in a Particular Segment

Think about it. When you specialize in a specific area, like residential apartments or commercial properties, you give yourself the chance to become an expert in that field.

You learn the ins and outs, the highs and lows, and, most importantly, the unique needs and preferences of your target tenants. Sounds pretty good so far, doesn’t it?

And there’s more!

Specializing allows you to focus your energy and resources on what you do best. Instead of spreading yourself too thin trying to juggle multiple types of properties, you can hone your skills, knowledge, and expertise in one area.

But here’s the best part: when you’re an expert, you stand out from the crowd. You become the go-to person for that type of property. And who doesn’t want that kind of recognition?

Pick a segment, learn everything you can about it, and watch your rental property business thrive like never before.

3. Arrange Suitable Financial Support

See, arranging suitable financial support isn’t just about having money in the bank. It’s about careful planning, smart budgeting, and securing the right kind of financing. And it doesn’t have to be as daunting as it sounds. Trust me!

First things first, take a good look at your finances. How much can you afford to invest? Remember, it’s not just about buying the property. There are also maintenance costs, insurance, taxes, and possible renovation expenses to consider.

Next, explore your financing options. Are you considering a bank loan? Or maybe private lenders or real estate crowdfunding platforms? Each option has its pros and cons, so take the time to do your research and find what suits your needs best.

Lastly, always have a contingency plan. Unexpected costs can pop up, and when they do, you’ll be glad you planned.

4. Employ or Appoint a Property Manager

As your rental property business grows, you may find it challenging to handle all the day-to-day tasks on your own. That’s where a property manager comes in.

Firstly, let’s talk about time – the one thing you can never get back. Managing properties can be time-consuming, especially if you own multiple units or buildings. By hiring a property manager, you free up crucial hours that you can then invest in growing your business or even just enjoying some well-deserved downtime. Sounds appealing, right?

Secondly, property managers bring their expertise to the table. They’re experienced in dealing with tenant issues, maintenance problems, and even legal matters.

Finally, a property manager can help ensure your rental business runs smoothly. They can keep vacancies to a minimum, maintain the property to a high standard, and ensure rent is collected on time.

5. Adopt Streamlined Procedures

If you ever feel overwhelmed by the countless tasks involved in managing a rental property business, it’s time to adopt streamlined procedures! This isn’t just about making your life easier – it’s about building a more efficient and profitable business.

Think about it. Wouldn’t it be great if you could automate routine tasks like rent collection or maintenance requests?

Imagine the time you’d save!

By leveraging technology, you can do just that. There are numerous property management software options out there that can help you track income, and expenses and even screen potential tenants.

But don’t stop there. Streamlining also involves setting clear procedures for your team. This could be anything from how to handle late rent payments to the process for addressing tenant complaints. When everyone knows what to do and when things run much smoother.

Remember, every minute you save on administrative tasks is a minute you can spend growing your business.

The rental property business can be challenging, but with the right approach and a little determination, you can make it a success. Follow these tips, stay focused on your goals, and never stop learning – and watch your business thrive!

Financing Your Rental Property Business

You’ve got your business plan, you understand the market, and now it’s time to secure the funding. But where do you start?

Let’s explore the different methods of financing and discuss their pros and cons to help you make the best decision for your business.

Conventional Bank Loans

Often seen as the most traditional route, conventional bank loans are a go-to option for many entrepreneurs. But what makes them so popular?

- Pros: They typically offer lower interest rates and longer repayment terms.

- Cons: They often require a substantial down payment and a strong credit history.

Every bank has its criteria, so it’s worth shopping around to find the best deal.

Hard Money Loans

Hard money loans are another option. These are short-term loans provided by private investors.

- Pros: They’re quick to secure and rely less on your credit score.

- Cons: They come with higher interest rates and shorter repayment periods.

Hard money loans can be a good option if you’re planning to renovate and flip a property quickly.

Private Money Loans

Private money loans are similar to hard money loans but come from individuals you know, like friends or family.

- Pros: The terms can be more flexible, and approval might be easier.

- Cons: Mixing business with personal relationships can be risky.

Always ensure both parties are clear on the terms to avoid any misunderstandings.

Home Equity Loans

If you already own property, tapping into your home equity can be an option.

- Pros: They usually have lower interest rates than other loan types.

- Cons: Your home is used as collateral, so there’s a risk of losing it if you can’t make repayments.

Seller Financing

Seller financing is an agreement where the seller acts as the bank, and you make payments to them.

- Pros: It often involves less paperwork and quicker closings.

- Cons: Not all sellers are willing or able to offer this type of financing.

Business Loans

Lastly, there’s the option of business loans, which can come in various forms like traditional bank loans, business term loans, or lines of credit.

- Pros: They’re designed specifically for businesses and might offer larger loan amounts.

- Cons: They often require a solid business plan and financial records.

Securing financing isn’t just about finding the money. It’s about finding the right kind of money. So consider your business plan, your financial situation, and your long-term goals.

Always consult with a financial advisor or lending professional to ensure you’re making the best decision for your rental property business.

Setting Up Your Business Operations

You’ve got the financing figured out, and now it’s time to set up the nuts and bolts of your operations. Let’s dive in!

Creating a Business Plan

One of the first steps you should take is writing a comprehensive business plan. But what does that involve?

- Executive Summary: This is a snapshot of your business. Include your business name, location, and what it does.

- Market Analysis: Understand your competition and potential customers. What are the industry trends?

- Organization and Management: Who runs the business? Explain your business structure here.

- Service or Product Line: What are you offering to your clients? Detail your properties here.

- Marketing and Sales: How will you attract and retain customers? Outline your strategies here.

- Funding Request: If you’re seeking funding, explain how much you need and how you’ll use it.

- Financial Projections: Provide an outlook of your business finances for the next five years.

A well-thought-out business plan isn’t just a roadmap for you—it’s also a tool to attract potential investors or lenders.

Keeping Track: Income and Expenses

Handling finances can be tricky, but it’s crucial for the success of your rental property business. Here’s how to do it right:

- Separate Bank Account: Open a bank account exclusively for your business transactions.

- Accounting Software: Use technology to your advantage. Accounting software like Quickbooks or Freshbooks can help you stay on top of your income and expenses.

- Record Keeping: Keep track of every expense related to your business, including repairs, maintenance, utilities, and taxes. This information will help you determine the profitability of each property.

It’s necessary to track your income and expenses diligently. It’ll help you understand your financial health, make informed decisions, and stay on top of tax obligations.

Importance of Online Presence

Let’s face it: we live in a digital world. Establishing an online presence for your rental property business is crucial. It can help you:

- Reach more potential tenants.

- Showcase your properties 24/7.

- Build credibility and trust with your audience.

You might consider setting up a professional website, utilizing social media platforms, or leveraging online advertising to reach your target market.

Read: How To Build An Audience For Your Business: 15 Best Strategies

Setting up your rental property business might seem overwhelming at first. But by breaking it down into manageable steps—like creating a business plan, setting up a bank account, tracking income and expenses, and establishing an online presence—you’ll be well on your way to knowing how to start a small rental property business and running it successfully.

Mastering Property Management and Maintenance

As a rental property business owner, you’re not just in the real estate market but also in the service industry. Providing quality and well-maintained properties is crucial for tenant satisfaction, retention, and long-term success.

Self-Managed or Hire a Property Manager: Which is Right for You?

First things first, you need to decide who’s going to manage your properties. Will it be you or a professional property manager?

This isn’t a decision to be taken lightly, as it can significantly impact your business.

Option 1: Self-Management. This means you’ll wear all the hats – from finding tenants and collecting rent to handling repairs and dealing with legal issues.

It might sound overwhelming, but it gives you full control over your business and helps save on management fees.

Option 2: Hiring a Property Manager. If the idea of being a jack-of-all-trades doesn’t appeal to you, or if you simply don’t have the time, hiring a professional property manager could be a wise choice.

They’ll handle all the day-to-day operations, freeing up your time to focus on growing your business.

It’s all about finding the right balance that works for you.

The Importance of Regular Maintenance and Repairs

Now, let’s talk about maintenance and repairs. Sure, it might seem like an added expense, but trust me, regular maintenance is key to keeping your properties in top shape and your tenants happy.

Plus, it can help you avoid major repair costs down the line. Think of it as an investment in your business’s future.

Tips for Dealing with Tenants

Finally, let’s touch on dealing with tenants. After all, they’re the heart of your rental property business! Here are a few tips to help you build strong tenant relationships:

- Communicate Clearly and Regularly: Keep your tenants informed about any upcoming maintenance or policy changes.

- Be Responsive: Respond to their concerns and requests promptly. It shows that you value them and their comfort.

- Respect Their Privacy: While it’s your property, it’s their home. Always give notice before visits and respect their personal space.

And there you have it!

With time, patience, and a little bit of guidance (wink!), you’ll soon master the art of managing and maintaining rental properties.

Expanding and Scaling Your Rental Property Business

Congratulations! You know how to start a rental property business and manage your properties successfully. Now it’s time to learn how to take it to the next level – expansion and scaling.

The first question to ask yourself is, “When should I expand my portfolio?” The simple answer is: when you’re ready.

This might sound vague, but it’s true. Being ready means having a solid understanding of the market, a stable financial situation, and the time and energy to manage more properties.

As for ‘how,’ here are some strategies:

- Buy-and-Hold: This involves purchasing a property and holding onto it for some time, during which its value appreciates. It’s a long-term strategy that requires patience but can yield substantial returns.

- BRRRR (Buy, Rehab, Rent, Refinance, Repeat): This strategy involves buying a property, renovating it, renting it out, refinancing it, and then repeating the process. It’s a quick way to build your portfolio if done correctly.

Now, let’s discuss how to scale your rental property business. Here are two strategies that successful entrepreneurs swear by

Leveraging Technology

Embrace technology to streamline your operations. From digital marketing to online rent collection, there are numerous tools available that can save you time and money.

- Property Management Software: These are designed to help manage properties efficiently. They can handle tasks like tenant screening, rent collection, and maintenance requests. Examples include AppFolio and Buildium.

- Digital Marketing Tools: To attract potential tenants, you need a solid online presence. Tools such as Google Ads, Facebook Ads, or SEO platforms like SEMrush can help you reach your target audience effectively.

- Online Rent Collection Platforms: Collecting rent is now easier than ever with platforms like Zillow Rental Manager that allow for easy online payments, saving you from the hassle of traditional payment methods.

- Virtual Tour Software: In today’s digital age, virtual tours are becoming increasingly popular. Tools like Matterport or Zillow 3D Home can provide an immersive experience for potential tenants, increasing the chances of them renting your property.

Building a Strong Team

As your business grows, you’ll need a reliable team to help manage your properties. This could include property managers, accountants, lawyers, and maintenance staff.

It’s important to make sure your team is well-trained and knowledgeable in the real estate industry so they can help.

As you can see, growing your rental property business is a journey that requires careful planning and strategic thinking.

But with the right tools, strategies, and a dash of determination, you’re well on your way to building a successful rental empire.

Challenges In Rental Property Business and How to Overcome Them

Learning how to start a rental property business is a challenge in itself. That said, there are a few issues you’ll face along the way that can be difficult to manage.

However, as with any business, there are bound to be challenges along the way. But don’t let them discourage you! Here are some common hurdles faced by rental property business owners and how to overcome them:

- Property Advertisement: Finding the most effective ways to advertise your property can be a mountain to climb.

- Rent Collection: The exhausting job of keeping track of rent and bill collection can be a tough row to hoe.

- Document Management: Ensuring all legal and financial documents are properly managed is crucial yet challenging.

- Property Maintenance: Keeping your properties in top shape requires time, money, and effort.

Practical Tips for Overcoming These Challenges

Now, let’s talk about solutions:

- Effective Advertising: Leverage online platforms such as social media, real estate websites, and local newspapers for advertising. Remember, high-quality photos and detailed descriptions can make your property stand out.

- Automate Rent Collection: Consider using online payment platforms to automate rent and bill collection. This not only saves you time but also ensures timely payments.

- Organize Documents: Use digital tools to store and organize all your documents. This will make it easier to access them when needed and ensure they’re safe.

- Regular Maintenance: Schedule regular maintenance checks to keep your properties in top condition. This can also help prevent major repair costs in the future.

And don’t forget to hire reliable contractors for any repairs or renovations.

Wrapping Up

Now, you have a handle on the common challenges in starting a rental property business and practical solutions to overcome them.

From effective advertising, automating rent collection, and organizing documents to regular maintenance – we’ve covered it all in this guide on how to start a rental property business, haven’t we?

But remember, every challenge is an opportunity in disguise. It’s all about how you tackle it. And with these actionable tips, you’re already a step ahead.

So, are you ready to jump into the exciting world of the rental property business? I’m sure you are! Remember, it’s your entrepreneurial spirit that’ll guide you through this journey. Go ahead and conquer the world, one property at a time!