Budgeting for beginners can often be intimidating, isn’t it?

- What is Budgeting?

- Budgeting for Beginners: Why is it Important?

- Budgeting for Beginners: Benefits

- Budgeting for Beginners: How to Get Started?

- Budgeting for Beginners: Tips for Saving Money

- Budgeting for Beginners: How to Stick to Your Budget?

- Budgeting for Beginners: Strategies For Making Budgeting Easier

- Budgeting for Beginners: Common Mistakes to Avoid

- Budgeting for Beginners: Apps and Tools To Help You Get Started

- Conclusion

- FAQ

Financial planning can be overwhelming and intimidating, especially for beginners. But having a budget and taking control of your finances is a powerful tool that can help budgeting for beginners and make intelligent financial decisions and achieve your financial goals.

Be ready to take control of your finances by creating a budget right away! With the right guidance and some simple steps, creating a budget that works for you doesn’t have to be complicated.

What is Budgeting?

Budgeting is a financial plan that helps you manage your income and expenses. It lets you track your expenses and find ways to reduce and save money regularly. It also enables you to create savings goals and prioritize what is important to you financially.

A budget is about tracking your money to have financial freedom and make the most of it. Budgeting is essential to financial management and is recommended for everyone, regardless of income level or financial situation.

Budgeting for beginners is also a great way to build financial confidence and develop good money habits. A plan for spending your money will help you stay out of debt and create a savings plan.

Budgeting for Beginners: Why is it Important?

A budget is crucial for financial security and long-term success. Managing your finances can be overwhelming when you need help knowing where to start.

Budgeting is a great way to grasp your financial situation and plan for the future. Budgeting will allow you to see where your money is going and how much you have to spend. Moreover, it will help you comprehend your financial goals and the strategies necessary.

It will help you prioritize what’s important to you financially, avoid unnecessary spending, and get out of debt faster. Budgeting can seem challenging at first, but when you get into the rhythm of it, it will become second nature.

Once you get into budgeting and tracking your spending, it will become an essential part of your financial management. Budgeting can help you grasp your finances, create a savings plan, and track your progress toward financial goals, and it will pay off in the long run.

Budgeting for Beginners: Benefits

Planning is the key to efficient money management. If you are not aware of your spending habits, it’s simple to let your money flow out of control.

There are several benefits to creating a budget to assist you in keeping on top of your finances. Here are a few:

Source

1. Boost Savings

One of the most common budgeting benefits is increasing your savings. If you need to save more, budgeting can help you.

By tracking your spending, you can see where your money is going and make changes to save more. Your goals can achieve more easily by employing a budget to assist you in finding areas where you can make savings.

2. Reduce Debt

If you have debt, such as student loans or credit card debt, budgeting can help you pay it off faster.

Budgeting can help you adjust your savings and expenses so that you can direct more toward your debt. Some people like to use what is known as the “debt snowball method,” where you handle all of your extra money towards your smallest debt until it is paid off.

At that point, you take that payment and add it towards your next smallest debt. This method can help you make faster progress toward debt freedom.

3. Achieve Financial Goals

Budgeting can also help you achieve financial goals, including saving for retirement or paying off student loans. You can set financial goals and track your progress over time. This can help you stay motivated and stay on track with your goals.

4. Establish Stability

Budgeting can also help you create financial security.

Long-term and short-term financial objectives like home ownership or retirement savings and short-term goals like paying off credit card debt can also incorporate into your budget.

Budgeting can direct your money toward your long-term and short-term goals. This can help you create financial security for the future.

5. Financial Management

Another benefit is having more control over your finances. When you first start budgeting, keeping track of your goals will become easier. Budgeting can help you get more control over your finances.

6. Helps You Accomplish Goals

Another budgeting benefit is that it helps you stick to your goals. When you’re budgeting, you’re setting financial goals for yourself. These goals include saving for retirement, paying off debt, or investing. Budgeting can help you stick to these goals to meet your financial goals.

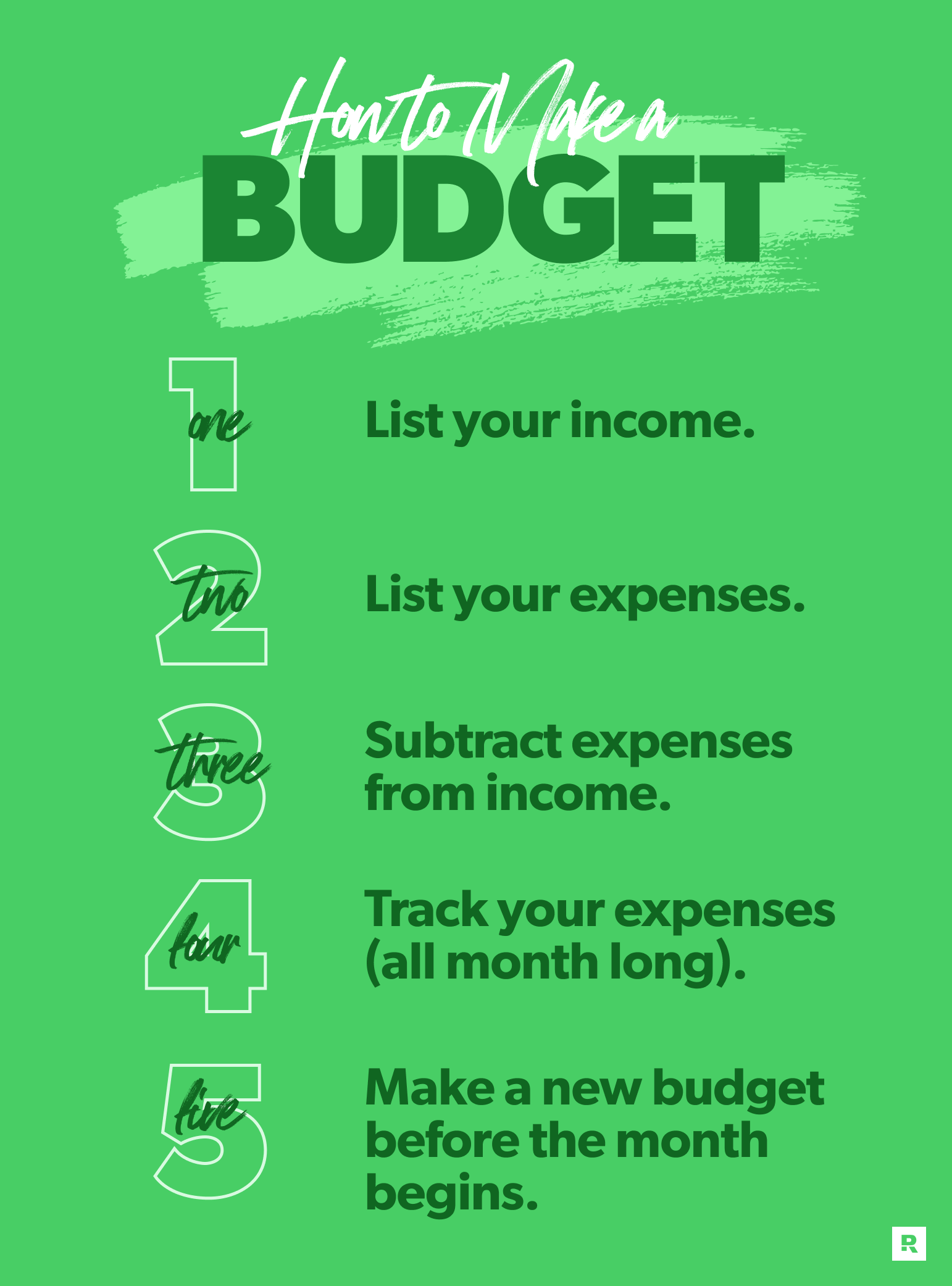

Budgeting for Beginners: How to Get Started?

Financial planning can be daunting, but a few simple steps can help you become a budgeting master. Whether you’re trying to save for a big purchase or want to be more mindful of your spending habits, learning how to budget is a helpful skill.

With a few steps, you can start budgeting today and take control of your financial future.

1. Understanding Earnings

Identifying your income is the first step in developing a budget and financial strategy. The first step in budgeting and financial planning is understanding your income. This will help you determine your budget based on your monthly expenses and what you can afford to save.

Make sure to include all sources of income when calculating your total monthly income, including your take-home pay, side hustle earnings, child support, and alimony. While revenue is essential, tracking your expenses and understanding your spending habits is crucial.

Knowing how much you spend each month will help you determine which costs you can cut and which ones will allow you to budget more effectively and create a healthy financial future. Include recurring monthly expenses, like your mortgage or car payment, and one-time costs, such as your property taxes or yearly registration fees, while keeping track of your spending.

It’s also essential to record your savings contributions and daily spending habits, such as how much you spend on groceries or how often you go out for coffee.

Budgeting is a continuous process and does not happen overnight. It’s essential to track your expenses for at least a few months to get an accurate picture of your spending habits and identify areas of improvement.

2. Setting Financial Goals

Define your financial objectives before you begin budgeting. These goals will help you determine where you want to be financially in the future and will make the budgeting process more effective and efficient.

Financial goals and objectives can vary, so be sure to factor them in if you have come up with any new ones when making your budget or decide against sticking with an old one.

Common financial goals include:

- Saving for retirement.

- Paying off debt.

- Increasing your monthly savings contributions.

- Building an emergency fund.

There is no ideal time to create financial goals. The vital factor is that you set financial goals and prioritize them, as they are the foundation of any budget. It will help if you understand where you want to be financially in the future to budget effectively and achieve your desired outcome.

3. Creating a Budget

Now that you understand your income and financial goals, it’s time to create a budget. A budget is a visual representation of your financial goals; with one, it will be easier to keep an eye on your spending and stay on track financially.

There are numerous ways to create a budget, so it’s essential to find a budgeting method that works best for you. Some people prefer to use a pen and paper to create a paper budget, while others prefer to use a budget planner book or digital budgeting app like Mint to track their daily spending.

Regardless of the medium you choose to create your budget, it’s crucial to track your daily spending and stay mindful of your financial obligations.

It’s vital to remember that there is no perfect budgeting method. There are many different budgeting methods, and it’s essential to find the one that works best for you based on your spending habits and financial goals.

Budgeting for Beginners: Different Budgeting Methods

There are many different budgeting methods. Your best option will rely on your financial condition and money management habits. The most crucial factor to consider is choosing a plan that can work in any particular financial crisis, which is realistic and set in a way that is easy to follow.

1. Traditional Budgeting

Traditional budgeting is a great starting point for budgeting. It’s simple, easy to understand, and allows you to plan your expenses for the month ahead. Traditional budgeting does not regard savings, so it’s best for those with a consistent monthly income flow.

2. Zero-Based Budgeting

Zero-based budgeting is similar to traditional budgeting. The difference is that savings come first in the zero-based budgeting method. This method benefits those who have irregular monthly expenses and want to maximize savings.

3. The 50/30/20 Rule

The 50/30/20 budgeting rule is a simple yet popular budgeting method. The 50/30/20 budget rule is designed to better manage your finances by understanding where your money is going. This rule helps to track food, utilities, and housing spending; however, you can change the percentages to fit your needs.

4. The Envelope System

The Envelope Budgeting System is a budgeting method that focuses on different spending categories.

This method is recommended for those who have irregular monthly expenses and want to maximize the money they have left over for savings. The Envelope System focuses on the amount of money you spend on various categories, such as groceries, gas, entertainment, Etc.

4. Identifying Your Priorities

Another critical step in budgeting and financial planning is identifying your financial priorities. This will help you determine where your money should go each month and help you stay on track financially by allocating money to your highest financial priorities.

It is essential to identify your monthly financial obligations, such as rent or mortgage payments, utilities, student loans, and car payments, as well as your other financial priorities, such as saving money for retirement or your child’s college fund.

Once you’ve identified your monthly financial obligations and preferences, you can start prioritizing your spending and determine where you should spend your money. Creating a monthly plan is the most effective way to manage your spending.

A spending plan will help you determine which financial priorities to focus on each month and how to allocate your money best. You must actively manage your monthly spending plan and adjust it as needed to avoid overspending.

5. Managing Your Debt

Next, it’s essential to understand your debt, including your monthly loan payments, credit card balances, and outstanding bills. While debt is not suitable for your financial future, it can be helpful to have some obligations if appropriately managed.

A mortgage, for example, is often used to purchase a home, which is a significant investment that can increase in value over time. Mortgages are generally good debt, and keeping track of your monthly mortgage payments and other monthly obligations, such as student loans, credit card payments, and car loans, is essential.

It’s also helpful to set up a payment reminder to ensure you make your payments on time and stay on track financially. If you have debt, such as credit card debt or other unsecured debt, it’s vital to try eliminating that debt as quickly as possible to avoid paying unnecessary interest.

The best way to eliminate debt is to create a debt-reduction plan that includes setting aside a certain amount of money each month to pay down your debt. If you intend to save money in the long run, consider placing high-interest debt, like credit card debt, on a payment schedule.

6. Saving Money

You’ve set financial goals, created a budget, and started tracking your spending.

Now you’ll need to make sure you are adding money away in savings. This will help you reach your financial goals faster and provide you with a safety net if you are in a risky situation.

Once you’ve managed your debt, it’s crucial to start setting money aside for your financial priorities, such as retirement or your child’s college fund. While saving money may seem difficult if you have high-interest debt, there are a few ways to save money while paying down your debt:

- Consider refinancing your debt, which can lower your monthly payments and help you save money in the long run.

- Consider saving money in a savings account with a high-interest rate, such as a money market account, which can help you save money while paying down your debt.

- Consider taking a more active role in your retirement savings.

There are various ways to save money, but the important thing is finding a method that works best for you and helps you achieve your financial goals.

7. Investing Your Money

While saving money and investing for the future is essential, ensuring you have enough money saved for emergencies, such as medical or car repair bills, is also vital.

It’s necessary to have three to six months’ worth of living expenses set up in easily accessible savings accounts for emergencies. Once you’ve saved enough for emergencies, consider investing some.

There are numerous ways to invest money, such as opening a savings account and investing in stocks, bonds, or mutual funds. There are also many ways to diversify your investments, such as creating a portfolio of stocks and bonds or buying a mutual fund.

No matter your investment method, it’s crucial to stay informed and make smart financial decisions when investing your money.

Budgeting for Beginners: Tips for Saving Money

Savings will make it easier for you to attain your financial objectives and give you a safety net in case you encounter difficulties.

Saving money should be a priority, and there are ways you can save more money to reach your financial goals faster. Let’s look into a few easy tips to save your money.

1. Choose Cheaper Alternatives

If you want to buy something yet save money, consider purchasing a more affordable option. You can use a cheaper alternative to save money on your car or your cell phone plan.

2. Make a Budget for Your Groceries.

Make a grocery budget, and try to spend less every month. This will help you save money and make it easier to reach your financial goals.

3. Create an Emergency Fund

An emergency fund is the money that you set aside for unexpected expenses. This money should be kept separate from your savings and used only when necessary. An emergency fund will help you avoid taking money out of your savings and provides a safe zone if you are in an awful situation.

Budgeting for Beginners: How to Stick to Your Budget?

Once you’ve created a budget and started tracking your spending, you have to make sure that you stick to it.

This can be difficult, especially if you’ve never done it. You’ll need to ensure that you stick to the budget and don’t make any unnecessary purchases. This can be easier said than done, but it can be done with a little effort and determination.

If you find it challenging to stick to your budget, try setting a budget for each day. Consider reaching out to friends and family for support. This will make it easier to control your daily spending and help you reach your financial goals faster.

Having people around you who support you will make it easier to manage your financial goals.

Budgeting for Beginners: Strategies For Making Budgeting Easier

To make budgeting more manageable, you can adjust your spending habits. You can also prepare for budgeting by changing your financial habits. Some ways you can make budgeting easier include::

1. Track Your Spending

When you first start budgeting, it is better to track your spending for a few months. This will let you see where your money is being spent. You can either write everything down or use a spreadsheet or budgeting tool.

2. Find Ways To Save Money

You can change your spending patterns to make a place for savings once you understand your spending habits. Consider areas where you can cut expenses and save money.

3. Prepare For Budgeting

Additionally, you can prepare for budgeting by opening a savings account. This will help you save money for emergencies and short-term goals, such as paying off debt.

4. Stay Committed To Budgeting

You can make budgeting easier by staying committed to it. Budgeting takes time to learn, so don’t give up if it’s challenging. With time and practice, budgeting can be more accessible.

Maintaining practical and appropriate spending is necessary as it’s simple to get caught up in a spending craze and go over budget. It’s also important to stay consistent with your budget. By scheduling reminders to examine your budget routinely, you can keep track of your achievements and stay motivated.

Budgeting for Beginners: Common Mistakes to Avoid

Building a solid budget requires a firm grasp of your income and expenses, which can help you better prepare for any unforeseen financial issues you may face. Whether you’ve used a budget before or are setting one up for the first time, it could take a few tries to find what works for you.

Let’s look at some of the common budgeting mistakes and the actions you can take to assist in creating a budget that suits your needs.

1. Not Taking the Time to Understand Your Finances

Before you start budgeting, you must make sure you have a good grasp of your finances. Make sure you know what you’re bringing in, your spending, and your financial goals.

2. Not Being Honest with Yourself

Budgeting is all about being real. It will help if you are more truthful about your spending habits to create a budget that works for you.

3. Not Prioritizing your Financial Goals

Budgeting is more than tracking your expenses; it’s about prioritizing your financial goals. You need to know what your goals are and should create a budget that supports the same.

Budgeting for Beginners: Apps and Tools To Help You Get Started

Now that we’ve discussed the benefits of budgeting and some strategies for making budgeting easier, let’s look at some budgeting apps and tools that can help you get started.

There are many budgeting apps and tools available. These can help you track your spending and stay on track with your budget. You can also find apps that help you set financial goals, such as retirement savings.

1. Budgeting Apps

Numerous online budgeting apps are available to assist you in managing your spending. These services are a good option if you like the idea of budgeting with cash but want to avoid dealing with the inconvenience of composing a paper budget.

Some of the most popular budgeting apps include:

Mint: Mint is one of the most popular budgeting apps, with millions of users worldwide. You can use the app to track your spending, create a budget, and receive advice on investing and other financial topics.

You Need a Budget (YNAB): YNAB is another popular budgeting app. YNAB has been around for a long time and has a large user base. It also offers a free version, which many budgeting apps need to provide.

Level Money: Level Money is another popular budgeting app. This financial app allows you to set up budgets and automatically save in one place.

2. Budgeting Tools

You must have the right tool to track spending and keep an eye on income. And to help you manage your spending, various budgeting tools are available.

The Hustle Story: The Hustle Story offers tips and tricks for managing your money, including budgeting advice.

Get Rich Slowly: Get Rich Slowly is a blog that offers helpful advice on saving money, managing your finances, and creating a budget.

LearnVest: LearnVest is another website that offers free budgeting advice.

The Wise Finances Podcast: The podcast The Wise Finances offers budgeting and financial advice tips.

Conclusion

Budgeting for beginners is daunting, but it doesn’t have to be overwhelming. A financial plan is essential to managing your money and achieving your goals. By understanding the basics of financial planning, you can develop a plan that works for you and help you reach your goals.

FAQ

What is the purpose of a budget?

Having a budget fosters financial health. A budget makes making payments on time smoother, establishing an emergency fund, and saving towards significant purchases like a home or a vehicle by keeping track of expenses and adhering to a plan. Therefore, maintaining a budget provides an individual with a more secure financial position, both now and in the future.

What will happen if the budget is not met?

A budget deficit can lead to higher borrowing, higher interest payments, and low reinvestment, resulting in lower revenue during the following year.

What are some easy ways to adjust my budget?

- Review Your Spending

- Find Ways to Save Money

- Earn Extra Money /Start side gig

- Stop overspending

- Stop eating out

![21 Worst Shark Tank Failures And Why They Failed? [2024] 5 Shark Tank Failures](https://thehustlestory.com/wp-content/uploads/2021/11/Shark-Tank-Fails-Blog-Banner-2.jpg)